Test Owner

What an individual has to do to be allowed to offer a personalised recommendation on financial products to a client is well defined. There are qualifications to obtain, and minimum requirements for businesses to meet in terms of things such as capital and indemnity insurance.

But what we should call the individuals who give those recommendations for a living is nowhere near as certain.

A plethora of monikers abounds in the market. Some financial advisers like to be called a financial planner; others prefer financial life planner, life planner, financial coach, financial consultant, investment adviser, wealth planner or wealth manager.

Historically, there were tied and multi-tied descriptors to deal with. Now, within any of those categories we also need to be aware of restricted or independent status; and, within those, whether that restriction applies to the whole of the market or just part of it, and whether people want to call their service holistic or focused.

With the economic and market outlook still so uncertain, the public need advice more than ever, but they remain confused over the options. Never has there been a more important time to settle the debate once and for all — if, that is, a definitive answer even exists.

Polarised market

In the wake of (RDR), the financial advice market is said to have polarised.

On one side are ‘advisers’ whose mindset is stuck in the sales culture of the past. They have not progressed to earn additional qualifications, and their recommendations are mostly concerned with the product on offer.

Their focus is more on transactional issues than ongoing planning; on the performance of investments rather than a wider vision of a client’s financial life. They see their role as helping to pick the best fund managers for clients, not telling them how to spend their time or money.

They may not be as wedded to advanced questioning techniques that elicit clients’ deeper desires, or to elements of the planning process such as cashflow modelling, which can incorporate clients’ aims and objectives that are about more than just money.

Today, these ‘advisers’ are concentrated in some of the largest, vertically integrated firms in the market, or so the argument goes.

On the other side are ‘planners’ whose thinking has moved beyond this. They are more conscious of the emotional impact of money. They place real importance on coaching methods, listening skills and empathetic relationship building.

They may have technical skills and knowledge of markets but their bent is towards soft skills, on helping clients decide what they really want out of life and learn how their finances can help get them there. They may be much warier of how a client’s wider financial life is organised, and how their wants across family, work and leisure play into their thinking about money.

These ‘planners’ may charge more for ongoing services because this relationship is one where they will be a constant guide to keep the client on track.

To do that, the emphasis has moved away from which products are best; a question that is almost irrelevant because direct-to-consumer options have become so widely available and cheap. The value the adviser adds is in the plan, not the product, hence they feel entitled to adopt the ‘planner’ tag.

Rarely is the argument made that either way of thinking is inherently bad for clients. After all, transaction-led advice was exactly what the majority of advisers were providing before 2013, and what the bulk of advisers in the market today were weaned on as life offices provided the default route into the sector in years gone by.

Different offerings

But clearly there is a difference between what is on offer in each scenario. Those in the life planning camp have been clear that calling adherents of one approach ‘financial advisers’ and those of the other ‘financial planners’ is the only way to enable prospective clients to differentiate what they are getting, and it is only fair that they can enter discussions armed with that knowledge.

The difference between a financial adviser and a financial planner is the difference between an industry and a profession, some claim, asserting the inherent superiority of the latter title because of the approach taken by planners compared to advisers.

To be called a planner, the person should be producing proper financial plans using scenario planning. If that is not what the individual does most of the time, their entitlement to be called a financial planner becomes less certain.

The problem is, pick any financial adviser and the chances are you will find elements of every tag in the way they go about their work. It would be a rare adviser who never discussed a client’s wider life, nor employed some of the same techniques used by someone with a formal coaching qualification — even if they were not consciously doing so. With suitability requirements as stringent as they are today, a sale without a thorough understanding of the client’s objectives is a one-way ticket to regulatory trouble.

Similarly, you can focus on the plan as much as you want but at some point you will have to touch the investment or platform solution that makes it a reality. Even clients that were most receptive to the life planning approach would be surprised if their planner’s knowledge of funds was noticeably sub-par.

One way to carve a dividing line between adviser and planner would be by giving no product recommendations at all. But it would be a crude division. Even if the bulk of their business was about coaching, a planner might want a couple of clients to whom they distribute products. Would their entitlement to call themselves a planner be revoked the second they put a product in the hands of a client?

Eye of the beholder

In a sense, it is immaterial with which side you agree. Planning is in the eye of the beholder; we have seen from the chequered history of sales-led advice that there are plenty of people within ‘advice’ firms who are adamant they are doing proper planning, despite the sales targets.

These salesmen would continue to brand themselves as financial planners, and other planners and consumers are currently powerless to stop them doing so.

It would take a very clued-up client to be able to identify those who were abusing the ‘planning’ title, even if a consensus was reached on who should be entitled to use it, or a standard was set out in law.

Individual qualification bodies can police the use of their titles. You cannot claim to be, say, a chartered financial planner with the Personal Finance Society (PFS) if you are not, and the PFS can strip people of the title if it is misused.

But financial advice itself is not a protected term; anyone can claim to be a financial adviser. This has led to a worrying uptick in social media stars reinventing themselves as independent financial advisers, and reams of unwise ‘financial advice’ spewing from social media platforms.

This is one of the instances where what an adviser is called could actually matter; the term adviser could be used to describe regulated, highly qualified, trustworthy professionals, as opposed to chancers who were simply hijacking the title.

Only those with senior management functions were described as authorised in the first version of the register revamp. Certified staff were listed under the heading ‘Regulatory approval no longer required’, leaving consumers understandably perplexed as to whether these advisers were even permitted to give advice.

A more straightforward taxonomy that divides professionals from amateurs could be a huge step in driving savers in the right direction while the regulatory resources remain mired in confusion for even the most seasoned market watchers.

The ability to display professional body membership on the new FCA Register is a positive change but, again, these bodies confer a variety of titles on members.

A chartered financial planner and a chartered wealth manager are two different examination standards, majoring on different skillsets.

Arguably, there is still a solid demarcation between the two that clients should be aware of. But listing either title carries more weight than just the headline ‘financial adviser’, which should help drive more new recruits and clients to the profession’s door.

Cutting to the quick

Plenty of advisers do not believe that rigid policing of titles is necessary. Suggesting one type of adviser is more evolved than another will not endear the profession to the general public. It can also be used to inflate the standing or competitive position of a particular firm above potential rivals.

But those who make the case for separation argue that there is a bigger divergence than ever between the offerings of different types of adviser.

The aftermath of the RDR has seen the biggest firms get even bigger. They have also started to control more of the value chain. Nowadays, there is barely a provider that has not moved towards vertical integration in one form or another.

While independent advisers have splintered away from tied models, advisers at firms backed by household brands nearly always sit within the same company that owns the funds, the discretionary management or the platform they recommend.

This is all the evidence some need to argue that putting the word independent in front of adviser is not just a semantic flourish.

It cuts to the core of a cultural gulf that exists between small, genuinely independent businesses and restricted behemoths nudging their advisers in a particular direction to suit the group’s commercial ends.

But, critics claim, it is only right that staff within such a framework are called, say, wealth managers, and the independent label remains sacred to those who truly are free from potential bias.

Suitability review

FCA data has found that there is no difference in charges, for example, between independent and restricted advisers.

At its last suitability review, the regulator found that restricted advisers, those within a network and those in firms with 25 or more advisers had marginally higher scores than independent advisers, directly authorised advisers and smaller firms respectively.

That will not stop many continuing to baulk at the notion that restricted ‘wealth manager’ salespeople are being put in the same bucket as IFAs.

This is hardly a new debate. It has been hovering around for years, borne of the way we talk about financial planning as a fresh and distinct profession from anything that preceded it.

Again, the key is not to conflate financial planning with anything else. As a consultation the previous year alluded to, this could also potentially rule out putting words such as wealth or retirement in front of planner.

Where next?

Undoubtedly, calls will grow to protect it from intrusion as financial ‘experts’ of all shapes and sizes try to trade on the knowledge and experience of the regulated profession , without earning a fraction of the qualifications.

Fighting over whether someone should be called an adviser or a planner may look like an internecine conflict. But it is a battle that matters to so many who have studiously ploughed through tough exams and professional development courses in recent years. It is up to the regulator to decide where the matter goes from here.

The majority of advised UK clients now desire ethical investing due to the Covid pandemic, according to a new report from Prudential.

The report looks at intergenerational planning and wealth transfer between advised families amid the financial volatility and insecurity of the pandemic.

It found that Covid-19 has increased appetite for sustainable investments across all generations among 60% of millennials, 44% of Gen X and 35% of Baby Boomers.

The report shows that 61% now care more about the environment and the planet than they did before the pandemic.

More than a quarter of respondents admit they are more concerned than they have ever been. And one in five say they are more worried now that they have children and grandchildren.

According to the report, the pandemic has shifted the financial priorities for many adults who now seek financial advice.

One in two respondents said they had either already sought advice or were planning to because of the pandemic.

And just over one in five were seeking advice to ‘begin their ‘investment journey’, potentially fuelled by individuals who had built up savings, not having the traditional outlets for spending their income.

The report also shows that while the trend is common across the generations, it is millennials who are leading the charge.

Experts say “With £5.5trn in personal wealth due to be passed to the next generation by 2047, the role intergenerational planning advice played, prior to the pandemic, was already a significant one. Yet the crisis has reframed financial priorities. Not just for those later in life with IHT liabilities, but for all generations.

“Once perhaps viewed as a fad, sustainable investing is becoming normalised, making it a fundamental building block within intergenerational financial planning. It also enables clients to leave their children more than just a financial legacy in terms of planet, environment, and society.

“With two in five advised clients surveyed confirming they expect to increase the amount they invest in ESG investments over the next five years, incorporating responsible investments into recommendations will become increasingly critical and provides advisers with an exciting opportunity.”

To discuss the Scottish permanent job placements, let us see the permanent and temporary job explanations. Clients need a member of staff that will work with them in a permanent employment contract. This also includes the fixed terms contracts. In addition, you may be eligible for a full employee benefit offered by your employer or client for permanent positions.

While in temporary jobs, your clients need a staff member to work along with them on a flexible basis. These assignments will mostly be for a fixed term and will cover illness cover, increases in workload, and paternity cover.

In the past month, there was a new record growth present in the number of individuals securing permanent jobs in Scotland, as per a survey of recruiters. The Royal Bank of Scotland Report on Jobs found that permanent appointments rose to the second-fastest rate as the labor market survey launched in 2003.

The data of Scottish permanent job placements has also shown another uptick in all of the temporary staff billings happening in Scotland. Respondents mostly attributed an increase to a greater demand of staff members in increased economic activity. It was observed that the UK economy was set to grow at the fastest rate in over 70 years, whereas the UK service sector growth has hit a high of seven years.

The jobs report was released a day later. The Bank of England suggested the UKL economy will also enjoy the fastest growth in over 70 years in 2021 when Covid-19 restrictions are being lifted. The overall economy is expected to expand by 7.25% this year, with the extra government spending assisting to reduce the job losses.

The rise in April in the permanent placement in Scotland, the fourth monthly increase constantly in a row, was quicker than that observed for the UK.

Meanwhile, the Scottish recruiters have also registered a fall in the total availability of permanent candidates throughout the month. Respondents have also noted that the job seekers have remained uncertain of switching their roles because of the pandemic.

The supply of short-term staff in Scotland also fell more in April. Recruiters hence recorded another huge rise in the temporary vacancies, having the latest upturn. This was the steepest one since July 2017.

This expansion was also a lot quicker than that of the registered ones across the UK.

Some Positive Signs In This Scenario:

RBS chief economist Sebastian Burnside said that the Scottish labour market has always continued to perform strongly in the second quarter of this year. This performance has been for both the permanent appointments and temp billings.

He also said: ‘Further positive signs came from the vacancies data, highlighting more surges in the demand for short term and the permanent staff. It is a very clear indication that companies in Scotland are stepping up the hiring practices in line with the situation of pandemic-related restrictions getting eased up a bit.’

‘The switch to hiring the permanent staff might also reflect improved confidence and a very clear outlook in the Scottish firms. But, overall, the whole data point to the sustained recovery of the labor market, being businesses assume a return to more normal business conditions in the coming summer season.’

The permanent staff appointments in Scotland have escalated a lot during April, increasing the fastest one since 2017. This is also the second strongest on record as per the latest Royal Bank of Scotland Reports on Jobs.

The Jobs reports were released just a day after the Bank of England suggested that the UK economy enjoy a super-fast growth in over 70 years during 2021. Agencies have also reported an increase in the short-term vacancies in the last part of the third quarter.

The report has stated that the candidate availability got far worse in September, having permanent labor supply decreasing at its quickest pace in the past 7 months. In addition, the short-term staff availability also declined at the steepest rate since June 2015.

In both these cases, the deterioration rates were always too strong compared to their respective UK averages. However, the job openings in Scotland remained on the rising side last month, having permanent vacancies increasing with a mark on the quickest pace over the last three months.

Scottish recruitment agencies have also reported the sharpest rise in permanent jobs in Scotland since July 2014. At the same time, this survey has also seen a rise in temporary staff billing. While on the same time, pay pressures intensified, while rates of starting salary and the temp wage inflation fastened up.

EA to CFO - Creditfix

Jenson Fisher have been a fantastic recruitment consultancy and have helped find the perfect candidate for multiple positions over the last few years, ranging from difficult niche roles to senior, sensitive positions. On all occasions she has provided high calibre candidates that also proved to be a perfect match for our company and team culture. The process from start to finish is consistently professional but also personable, and it’s great to know I can rely on her insight into the local job market whenever I need advice. I cannot recommend Jenson Fisher highly enough.

As a firm that prides itself on providing our clients with the highest level of service quality, in addition to intuitive personal service, it is imperative that the staff who join the firm not only have proven expertise in their field, but also must demonstrate a passion for excellence and the highest level of customer service.

It has not always been easy to find candidates with the fully rounded 'fit' that we need. We have worked with a number of recruitment firms over the years and have found that we see the same candidates being put forward, time and time again who just don't meet our standards.

Working with Jenson Fisher has been a breath of fresh air. We have worked with Jenson Fisher for many years now and they is always our first port of call when we are hiring. Jenson Fisher are highly knowledgeable in their field and have taken the time to get to know us, our firm values and dynamics and knows exactly what we want from a candidate. They build strong relationships with both client and candidate alike which gives us the confidence that when they present a short list of candidates to us, that we know that they are well briefed on us as a firm, our values and expectations and the role that they are applying for.

Jenson Fisher's considered and thorough approach to our recruitment needs means that we have confidence not only in the qualifications and expertise of the candidates that they present to us, but also that they have the drive, values and commitment to excellence that we require.

I would highly recommend Jenson Fisher to anyone who is looking for a true partner to recruit candidates of the highest calibre to their organisation.

SCOTLAND'S ROAD TO RECOVERY

This month's data from the Office for National Statistics show that despite the incredibly challenging circumstances facing the job market, there is optimistic news. The unemployment rate in Scotland has remained steady at 4.4%, which continues to trend lower than the UK rate of 4.9%.

- 120,000 people in Scotland are currently unemployed, this equates to roughly 7% of the 1.67 million unemployed in the UK.

- The steady rate of unemployment in Scotland is largely due to the ongoing furlough scheme, boosted by the successful vaccine roll-out.

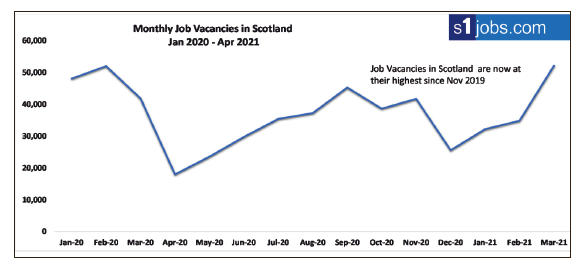

- The number of job vacancies advertised in Scotland has increased by 50% from February to March - the highest level since 2019.

- Job vacancies have been boosted by the sectors most impacted by the pandemic such as retail and hospitality reopening their doors next week.

Job Vacancies in Scotland 2021

Speaking in today’s Herald, s1jobs Commercial Director Gavin Mochan warns that some of these jobs may not be sustainable, “hospitality venues will remain under trading restrictions for an unspecified time to come, with indoor venues initially required to close by 8pm, and outdoor areas to shut by 10pm. Industry representatives have warned such conditions are not viable, with 24,000 jobs at risk.”

With restrictions easing and the vaccination roll-out going strong, there is much to be optimistic about. Yet, as Mochan notes, “the extent of the damage will only be evident in the weeks and months to come as the economy reopens and government support winds down.”

Real Estate Expert says the influx of houses to the market is negatively impacting sales

Although it has taken a significant hit, the property market is still operating as of now, granted it remains in line with current government provisions. As such, the activities required to move house are permitted as well, so long as current safety guidance is followed as set forth by the Scottish government. Listed approved activities include those such as home appraisals, inspections, mortgage applications, viewing (barring open houses), offers, and home moves (including those across country borders).

The question remains, however: is the property market currently suitable for first-time homeowners?

The Head of Residential Property at Thorntons, Ken Thompson, has something to say about this. He believes it remains afloat and has created market conditions beneficial to sellers, but also cautions that first-time buyers are likely to pay inflated prices for quick-turnover properties, resulting in a loss of profit when they decide to sell.

In a recent public statement, Ken remarked: “We’ve witnessed an immediate and sustained mini-property boom since the market reopened in June 2020. There’s been such a pent-up demand fuelling the marketplace that in some areas has meant supply has struggled to meet demand.

“This has led to an increase in prices for all properties from small flats to top-end homes, which in some areas of Scotland, including Edinburgh and the Borders, have been significant. The year on year average price rise to the end of December was 6.8% in Dundee and Angus, 6.5% in Perth and 5.3% in Fife.

“Sales are only restricted by the number of homes coming to market but the demand from buyers has remained undiminished and first-time buyers have played a large part in driving the market.

“Part of this has been, in part, due to the availability of Government Assistance through the Help to Buy ISA scheme. This has now closed to new savers and has been replaced in part by the slightly less attractive Lifetime ISA scheme.

“The First Homes Fund, a shared equity scheme providing cash loans of up to £25,000 to assist in the purchase of a first home, has also proved hugely popular. This scheme was closed to applications in October but has now re-opened for applications to assist with purchases that will complete on or after 1st April 2021.

“Assistance may also still be available to new buyers under the LIFT Open Market Shared Equity Scheme. Funding is limited and is subject to maximum price thresholds that are fixed by reference to the number of rooms in the house being purchased, and the area within which it is being purchased – but it could provide a welcome boost.

“To gather more information on these schemes, and get assistance with applications, prospective buyers should speak to a Mortgage Adviser.”

“Another current incentive is the fact that Land & Buildings Transaction Tax (LBTT) is not payable where the purchase of a property is at a price of £250,000.00 or less. That currently leads to a saving for buyers of up to £2100.00 but that only applies to purchases that complete on or before 31st March 2021.”

Amidst these major concerns for first-time homeowners, the increasing prices stand at the forefront. These elevated prices could have dire consequences for home buyers as they cause required deposits to climb to unreasonable levels.

Ken later goes on to add: “There was a concern last year when some of the major mortgage lenders pulled their maximum lending back to 85% of the value of the property being purchased. Finding 15% of the value of the property plus the sum necessary to pay a premium overvaluation to secure a property means finding a significant sum.

“Fortunately, most lenders have reversed their policy and will now lend 90% – and in some cases more – plus mortgages are relatively cheap because interest rates are so low. Costs can be fixed by choosing fixed-rate products to protect against rising interest rates in the short to medium term.

“Ultimately, I believe there is never a bad time to get onto the property ladder but if there is a word of caution for first-time buyers, it is that that they do not pay an inflated price in a bullish market for a property that, as a first home, they may themselves be looking to sell again in three or four years’ time. But for sellers, this is a perfect time as you will be feeding demand.”

According to a newly published report, the NEC stands at the forefront of over 115 million transactions per year for a variety of different services, such as bus travel, community memberships, and electronic payments in school cafeterias.

Managed by a little-known Dundee team, this national programme is used for an incredible amount of concessionary travel, with over 1.4 million people taking advantage of NEC benefits. In addition, of these 1.4 million, over 600,000 of them are young people who have been issued a Young Scot card.

This card is proving to be an amazing time and money saver, gifting the holder with eligibility for things like discounts, reward points, and PASS (proof of age scheme).

This card also helps locally in Dundee, driving forward a well-thought-out digital strategy conceived by the council to benefit areas such as lifelong learning, young people, transport, health, culture, and finance.

On Monday March 8th, the city council held a meeting regarding contracts for a new supply of the Customer Management System and Card and Bureau Services for the NEC scheme, which was met with overwhelming approval by the council’s policy and resources committee.

The Council’s own John Alexander commented: “At a time when the use of contactless cards has soared because of the pandemic, this report illustrates how Dundee City Council innovation has helped to develop a key method to deliver public services for people.

“Uses of the NEC and its popularity have grown over the last 15 years and I am pleased our city and team have been at the centre of these developments.

“This is about how technology can be used to help in people’s lives, to make massive projects like concessionary travel easy to use and to deliver.

“It is a great tribute to the forward-looking attitudes in our council that we continue to manage this successful national programme.”

This National Entitlement Card will continue to be funded by the Scottish Government to support effortless, quality access to public services for the entire 32 local councils currently in place. Additionally, the funds for this card will be administered by the Improvement Service, who has confirmed an extension of the current service agreement they hold between themselves and the Dundee City Council.

The younger generation is more inclined to invest in a post-COVID world according to new research.

According to the research results from OneFamily, a financial services provider, most young people especially between the ages of 18-30 are more inclined now to save more now than they would have one year ago. This survey showed that this was the opinion of 56% of people in that age bracket. In the face of the pandemic, more of these people have become more financially aware. Another percentage 38% according to the same research opined that they would be more inclined to put in money in financial assets like stocks and share-based investments.

This financial cautiousness of most young people stemmed from the realization that they were more likely to be laid off work, given a temporary leave of job or have had to look for a second job in the last twelve months compared to any other age-based demographic.

In the past year, young people below the age of 30 were able to add £1,480 to their savings on average. Not everyone in that age range saved as about 9% were shown to have not saved in the past year while about 13% were shown to have not saved up to £1,480.

The reason for the plan to save is centered around certain needs such as buying a home, saving for education and saving for a wedding. Where 13% are doing so for a home deposit, 11% are saving for a wedding and 16% have education as their reason.

“It’s been a tough time for all of us, so it’s understandable that the generation that’s been hit hardest is now more cautious about spending and are determined to build their savings”, opined Paul Bridgwater, head of investments, OneFamily

He goes further to say that taking precaution against future occurrences such as pandemic, recessions and employment is normal for the under 30 age bracket especially in the face of so much unpredictability.

People under the age of 30 have also prioritized the safety and future of the ecosystem and they show this by not using their money to fund companies that are doing damage to the environment. They make this stand even with the pressure building up.

According to Bridgewater, most young people became more inclined to save for a home after living with their parents or in a rented space that they could not make a permanent residence in the past 12 months. The consideration of using the 25% government bonus on a climate friendly Lifetime ISA might help to boost their savings pot whilst also appealing to their environmental ideals.

He goes further to say, “Meanwhile for those not looking to save specifically for property or retirement, a climate friendly stocks and shares ISA could help them to build their savings nest-egg at a time when interest rates are at a historically low level”

The answer to this question is a definitive yes! this pandemic has brought some amazing opportunities for everyone, it has opportunities for you to progress in your career and achieve the goals you intended to achieve.

There are four things you need to consider when you decide to have a career change, we will talk about each of them below.

The financial strength of the organization you want to join

This is one of the first things you do before joining any organization you check the organization's financials. especially their financial position before the covid-19 pandemic era. check out the companies' accounts online, company checks, etc. Anything you can find on the company’s financials.

Check out if the company is investing or cutting costs? All you are trying to do is to know if the company is financially stable or not. The goal is to know if the company financials are good enough to ride out a recession.

It is not limited to your research alone, even during the interview, ask your future employer questions to know how the recent events have affected the company's financial position and their plans.

Will the series of lockdowns affect the correct functioning of the company?

It is no news that the series of lockdowns had bad effects on different sectors of the economy, these sectors include hospitality, leisure, travel, and property. The lockdown prevents people from participating in activities that would boost these sectors.

But sectors like technology, financial services, and online retailing have had a little negative impact. The lockdown has given them a lot more positive impacts as they have a lot more customers now that rely on these sectors for most of their day-to-day activity during and after lockdowns.

You need to be cautious of the sector you want to move to because if it is a sector that is negatively affected by the lockdowns depending on the degree of effect, it would be a bad idea to venture into such sectors.

What kind of role would I be playing in the company? A business-critical role, revenue-generating role, or a luxury to the organization?

The kind of role you play in the organization matter a lot if your role in the organization is critical to the running of the day-to-day activities. Then the company will continually need your skills and experience. This is great as this would make you a valuable asset to the company.

On the order hand, if you are joining the organization in a revenue-generating capacity, you need to be sure your skill sets would be able to carry out such duty without disappointing the organization. You need to consider the pandemic and other external factors that might hinder your performance.

if your role is not business-critical or revenue-generating, and it is not essential to the company's core function then the probability of you being laid off during any recession is very high, as the organization would be trying to cut down costs.

You compare the new opportunity in the new organization and that of your current role in your organization?

Before considering new opportunities, you need to consider your current role and organizations. Ask yourself questions to know your true situation in your current organization.

Are you happy with your current role? Are there opportunities to progress beyond my current role in the organizations? Does my current organization value me? etc.

If your answers to this question are, Yes! Then you need to be sure if you are making the right choice to leave.

But if after answering these questions your answer is No! then you compare and consider the options you have with the one you had in your current organization.

Should I change jobs during a global pandemic?

Yes, provided the opportunity passes the four tests above. Make sure you stay open to opportunities, retain a growth mindset, and make sure the opportunities you select allow you to progress in your chosen career.